But this is a double-edged sword, as a greater volunteer deductible would imply a larger total up to be paid out of your pocket when your auto requires repair. You ought to pick only as much deductible as you can afford to pay out of pocket - laws. When going with a voluntary deductible, consider how much can you pay without it having an influence on your various other expenditures.

Bear in mind that a partially higher costs could conserve you a great deal of headache in instance of an unexpected accident - car. You do not need to stress about scheduling monies when you might currently be under significant stress and anxiety - car insured. Why Deductibles are used by Car Insurance Providers Car insurance carriers think that deductibles incentivize the insurance policy holder to be liable in their handling of the vehicle - cheap insurance.

As several of the expense of repair services will have to be borne by the insurance policy holder, she would be mindful in her use of the asset and, therefore, be able to make use of the automobile much better. Additionally, deductibles prevent insurance holders from submitting little insurance claims minimizing overhead expenditures entailed in resolving an insurance claim - vehicle insurance.

Think of it similar to this: when a kid initially obtains a cycle, the moms and dads are fretted about whether she would take treatment of the cycle - affordable car insurance. Some moms and dads tell their child that a component of the expense of any type of repair the cycle demands will be reduced from her pocket cash. This makes the youngster act properly as well as ensure that the cycle remains in excellent condition as much as feasible (credit score).

Not known Details About Who Pays The Deductible In A Car Accident? - Anidjar & Levine

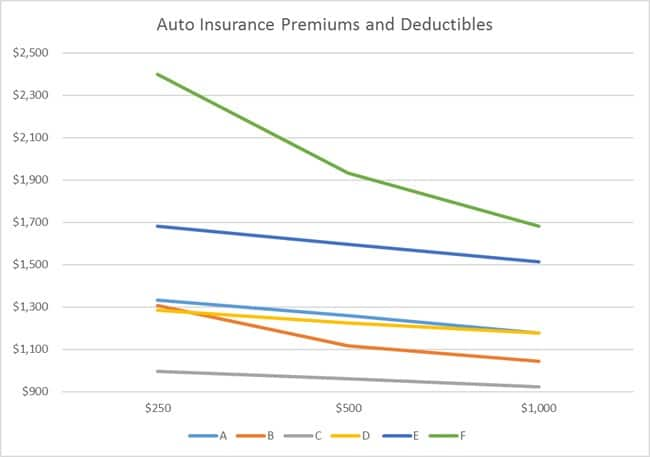

What is voluntary deductible in Automobile Insurance policy A voluntary insurance deductible is the amount that would have been paid by the insurance company under usual conditions, however you chose to pay it out of your pocket. Choosing to have a voluntary deductible included in your insurance cover lowers your auto insurance policy premium dramatically - vehicle.

You will need to choose exactly how much you agree to pay out of your pocket at More helpful hints the time of policy proposal itself (cheapest car). The deductible would certainly be related to every claim you file in the policy duration (cheapest car). The insurance provider will just pay the component of the case quantity that is over the overall volunteer and also required insurance deductible - insurance companies.

IRDAI policies have dealt with the value of required deductible in cars and truck insurance policy based upon the cubic capability of the cars and truck engine. Today, it is set at 1,000 for cars and trucks with a cubic ability as much as 1500cc, as well as at Rs 2,000 for greater cubic capacity. The compulsory insurance deductible does not have any kind of effect on the auto insurance coverage premium.

When to decide for insurance deductible auto insurance policy? The quantity of insurance deductible you select depends upon your comfort degree and also the quantity of threat you agree to take. When deciding on a volunteer insurance deductible, consider if you have a sufficiently big reserve available. You do not want to diminish the fund, if it is small, when you can prevent the same.

Some Known Questions About Who Pays The Deductible In A Car Accident? - Anidjar & Levine.

If you possess a costly car the costs for the cars and truck insurance policy will be high. It might make good sense to choose a tiny insurance deductible so as to save money on the costs. Remember that you would anyways not make small cases to accumulate your no case reward, so it would certainly be sensible to decide for a deductible equal to that quantity for which you would certainly anyways not file an insurance claim (insurance affordable).

Do you need to pay the deductible if the mistake is not your own? You only need to pay the deductible on the case that is paid out by your insurance firm - perks. If another party is found to be responsible, their insurance would certainly pay for the damages and you will certainly not have to pay any kind of insurance deductible. car.

How does insurance deductible jobs under auto insurance coverage? An insurance deductible is the amount that you have to pay per insurance claim before the insurance company pays for the remainder. So, if you sue for Rs 10,000 and also the insurance deductible is Rs 1,000 the insurer will just pay Rs 9,000 and also you will have to pay the remainder out of your pocket (insurance companies).

You might additionally select volunteer insurance deductible this does not have any type of ceiling. What are the deductibles for industrial automobile insurance plan? The required insurance deductible for commercial car insurance plan remain the same as for individual vehicle insurance coverage plan (insurers). You can also choose voluntary deductible based upon your comfort to reduce the car insurance costs (cheapest car).